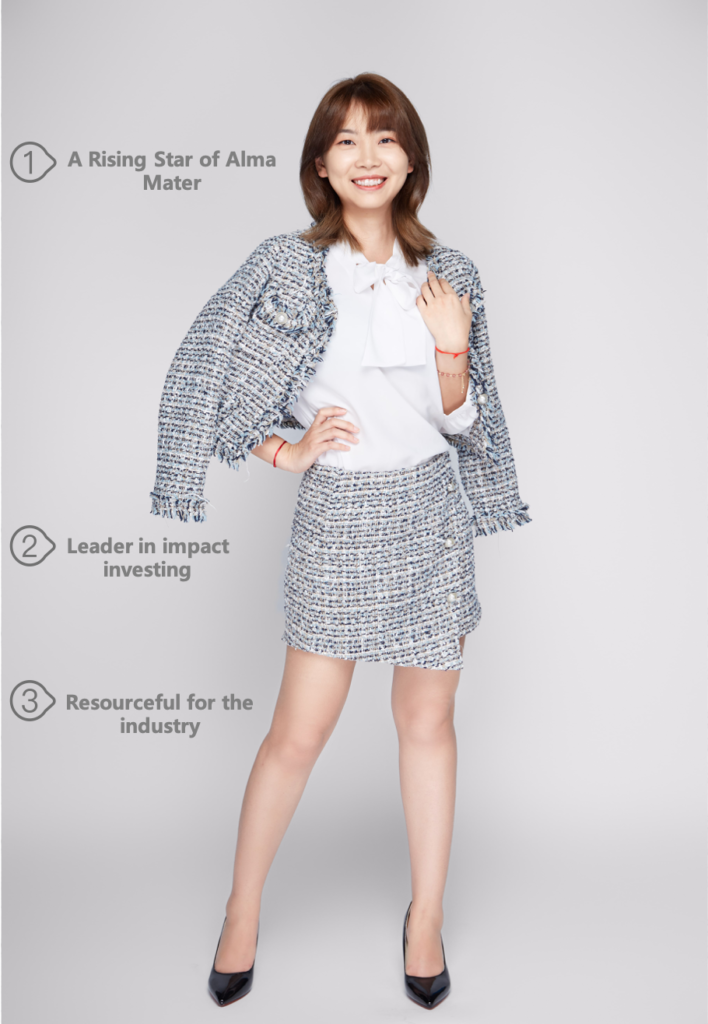

Hi this is Catherine. In my previous article, I mentioned about the connection with my alma mater and how it motivated my career. Now I am going to talk about how I have turned myself into a leader in green finance.

Part 2 : Leader in Impact Investing

A Green Leader In The Asset Management Industry

I am being referred as a “green leader” by market practitioners towards the end of last year, which is almost three years since I established AvantFaire Investment Management in 2017. Working on impact investment and green finance has been quite “lonely” as these themes are not well known, or frankly speaking, being ignored by the market. I was surprised by such unawareness in Hong Kong which is a mature financial market under all definitions. Compared to that of Canada in which I worked in the past, there are green finance standards and protocols – from due diligence, valuation to communication with green corporations and investors. All of these were absent in Hong Kong back then but there were several positive developments in last year. The Hong Kong Exchanges and Clearing Limited, Securities and Futures Commission, Hong Kong Monetary Authority and other government agencies respectively issued guidelines and supportive measures in green finance which offered market practitioners certain directions and starting points.

At the commencement of my business, I spent a lot of effort to recruit the right team members while I did not convince them with any unrealistic false hope. My team should mentally prepare to engage in green finance at a difficult time otherwise they would feel strenuous and unrewarding. I also need to discern between candidates having long term vision in green finance and those aiming for short-term benefit. It is important to recruit genuine partners to join the team, to prepare for headwind, and not to be distracted by other lucrative plays like bitcoin, blockchain, or hot emerging markets. The team must stay put on green asset management with AvantFaire.

During this period, I received a lot of affirmations, including China Daily’s report on my impact investment business and renowned corporate advisors offering me inspiration and guidance on a regular basis. On the other hand, I also need to clear doubt from partners and investors. The reason for my perseverance is straight forward. I reckon that doubt is a result of lack of understanding in the green finance industry. It takes time to understand a new theme. Let’s consider this. If impact investment does well and makes good profit, all players should be filled with encouragement, compliment and affirmation, shouldn’t they? This actually should be the case because the intentionality in impact investment is the core, and everyone is doing it with good faith. Nevertheless, there are still many questions about what impact investment is and why it can make money. I believe it is a necessary process for the market to doubt. A theme with good value is not necessary to attract all eyeballs at the same time otherwise its valuation will be inflated. It takes time for people to understand and familiarize with impact investing and its operating model. We must be patient and let the market to digest.

My entrepreneurial journey featured on China Daily

Many media reporting my business story thought I was a 90s born. I welcome this compliment but I actually belong to the 80s. There are few people in my generation engaging in green finance but that doesn’t mean I am very advanced neither. Many of my peers took the traditional path and went for management trainee programs in financial institutions after graduating from their bachelor’s or master’s degrees. I did exactly the same and went to join a bank while taking a part-time MBA degree. The only thing that differentiates me is my language skill where I am currently picking up my ninth language. My language ability adds a lot of value in my work, particularly in the due diligence process when extensive communication and appreciation of cultural differences are needed. I learnt Sanskrit grammar and early Buddhism during my startup phase in the University of Hong Kong. I am infused with Buddhism thoughts when it comes to investment and managing businesses. I tend to see through fundamentals of issues and not being distracted.

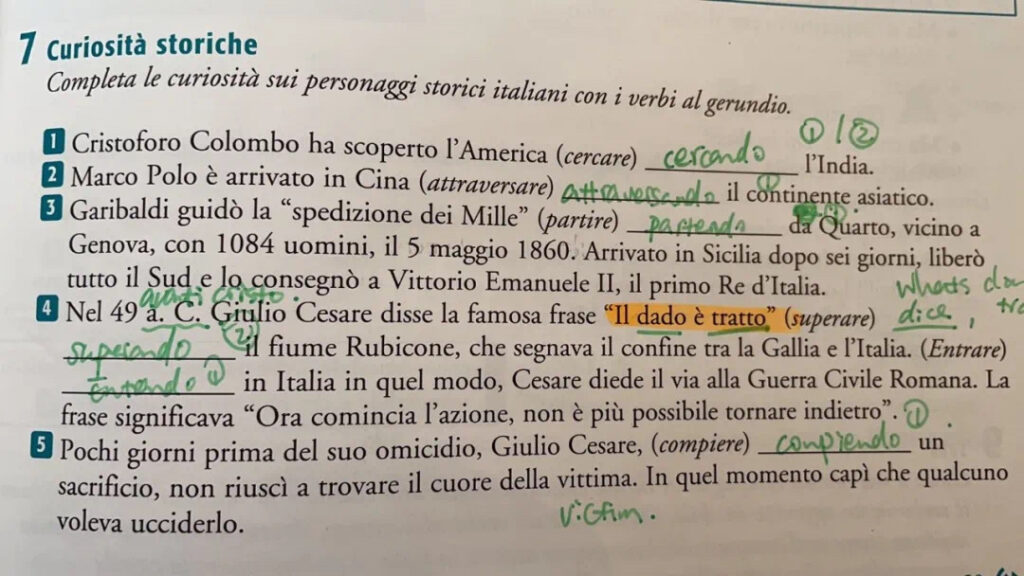

Recent fun fact: Christopher Columbus is Italian, though his expeditions were sponsored by the Spanish royal government

The green finance industry in Hong Kong and Asia is now very different than before. The carbon neutrality pledge by China has led Asia into a new green era. All industries start to pay attention to green initiatives. To a large extent we have gone through the most difficult period of green promotion and are now seeing the silver lining. Because of my persistence and hard work in impact investment and green finance, I become a scarce talent in the industry and am referred as a green leader by various parties and academic articles. Recently I read my grandfather’s memoirs about his work at the Ministry of Agriculture in China which gave me a deeper understanding of what I am doing now. For example, China’s food program has always adhered to the grassroot need of civilians since the First Sino-Japanese War. There was a mentioning in my grandfather’s memoirs that many squires and rich peasants back in old times had organized certain cooperative organizations to manage food program for the lower-and-middle-class peasants but in vain because of their unwillingness to share food and land resources. Although my grandfather was a rich peasant, he joined the organization of the lower-and-middle-class peasants and did a lot of practical work for them. I was very touched after learning his deed. I see two groups of wealthy investors in the market: high-net-worth investors who talk about impact investing but do not do anything practical, and other high-net-worth but low-key investors who actually utilize their wealth to initiate meaningful missions and projects. I always praise the latter as unsung heroes while criticize the former as opportunistic fame-seeker (who also love to make quick moneys through IPOs or sit in various policy committees to create influence.)

Solar Panel

To realize medium to long term profit in the green investment market, we must stay close to the need of people with a long-term perspective. Green investors may not be misers and may not care if they are recognized for social contribution. In long run they will benefit for their action, recognition and kindness. Here I want to praise the Rockefeller Family once again. In the spring of 2014 in New York, I met Justin Rockefeller who is the young generation in the family and applauded the prospect of impact investment. The Rockefeller Family has its investment made around the world to positively impact lives of many people. Such macro perspective has laid the ideological foundation through generations in the family. Impact investment is meant to revitalize the lives of people and the economy. It is the same for the Sustainable Development Goals (SDGs) of the United Nations which are meant for the benefit of all people. This is consistent with the idea of wealth management which can only be sustainable if it is really meant to benefit all people.

My photo with Justin Rockefeller at NYC 2014

It is an extraordinary moment for the green finance industry. We are in the process of searching for new directions and making new policies. To make green finance in Asia sustainable, we need continuous improvement of policies to ensure what we do is relevant and meaningful to the economy and people’s livelihood. Green policy covers all aspects of life. It is also the only economic development tool that combines finance with industry to create direct impact. We cannot make wild guesses in green finance and decide what the best for people is. Talents in green finance are scarce. Every word and suggestion made by green finance professionals would impact lives and well-being of many. During the engagement with my investee companies, I realized that strategies formulated by the management may not align with the expectation or need of the target group. It may well be better to understand issue from the human nature, habit and culture of the people within the process and system to better manage a project. We have to be result and purpose-oriented when performing asset management. Recently as a resident guest in the Wall Breakers-an online financial media platform, I discussed policy formulation and green finance with my peers in the industry. This year, I also set the goal to provide good policies and practical suggestions to the industry, and to offer a sense of direction to more practitioners with the particularities of Asia and China.

I have so far shared my observation, experience and expectation of the green finance industry. I hope during this extraordinary period of growth and transition, I can introduce more logical thoughts and interdisciplinary resources to consummate the development of green finance in Asia.

.

.