(photo credit : Valentin Farkasch @norobotyet unsplash.com)

The world has been in the pandemic mode for more than 8 months, which has dramatic impacts on financial markets all over the world. However, the value of green bond issued in the first nine months surged 12% over the previous year to more than $200 billion, according to research company BloombergNEF.

Only after an understandable dip in the 2nd quarter, all of the sustainable bond categories come roaring back. It seems that the pandemic is driving a boom in investments to fix the climate crisis, and green bonds may have a starring role in it.

Taking RBC (Royal Bank of Canada) for example, it is committed to provide $100 billion in sustainable financing by 2025. It has also developed a Sustainable Bond Framework under which it can issue three types of bonds: Green bonds, Social Bonds, and Sustainability Bonds. The proceeds of these bonds will be allocated to eligible categories that meet the 17 sustainable development goals (UN SDGs).

WHAT ARE GREEN BONDS

Green bonds are fixed-income financial instruments that have positive environmental and/or climate benefits. It’s also known as climate bonds. Like normal bonds, green bonds can be issued by governments, multi-national banks or corporations. It typically comes with a long maturity such as 10, 15, 20 years or more.

The first green bond was introduced by the European Investment Fund in 2007 under the name Climate Awareness Bond. In 2008, the World Bank coined the term “Green bond”.

The traditional bonds have a history of almost four hundred years. By comparison, green bonds are still at their infancy. Although green bonds have been growing rapidly, yet they only represent 1% of total global bond issuance.

Despite the intuitive appeal of investing in long-term sustainable projects, green bond may also have some possible down-side that investors need to be aware of. Green bonds typically have much higher transactions costs. Investors also need to know how exactly is the money being used, what the environmental impact is, which could result in a higher regulatory cost.

“Greenwashing” is another often-mentioned risk of green bonds, where business raises money in bond markets makes misleading claims about the green credentials.

Even if a green bond is ‘authentic green’, we may still want to know how green it is. Is the issuer committed to investing the proceeds specifically in projects that are beneficial for the environment? If the proceed is used by the fossil fuel industry, but to make it greener, should it be considered green or quasi green? Or, would you argue that anything to do with fossil fuels cannot be considered green? Unfortunately, there is no Pantone code to tell us exactly how green is one particular green bond.

THE GREEN BOND PRINCIPLES

To help the infant grow healthier and greener, a group of bankers and investors started to draft some common standards and process guidelines. In 2014, the International Capital Markets Association (ICMA) took over the Green Bond Principles (GBP) to improve them and to keep on developing them.

The Green Bond Principles promote integrity in the Green Bond market through guidelines that recommend transparency, disclosure and reporting. There are four components of these principles.

- Use of proceeds

- Process for evaluation and selection

- Management of proceeds

- Reporting

EXTERNAL REVIEWERS

External reviewers provide environmental due diligence in the green bond market. Many of the participants have been quite small. There are many types of external reviewers. External reviews provide transparency to investors, keep them alert of potential climate and environmental risks and impacts that feed into their financial decision making.

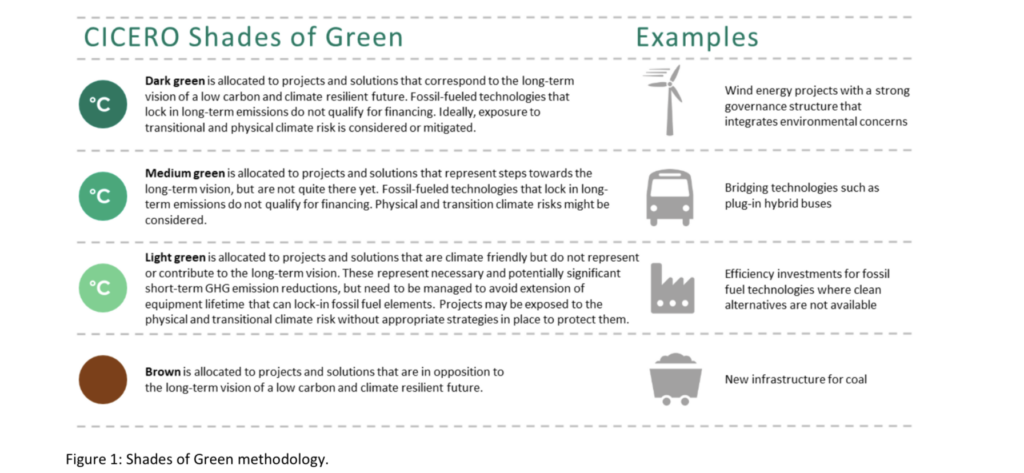

When we came up with the title of “Fifty shades of Green” for this article, we naturally thought of Cicero Shades of Green, who had helped establishing the model for second opinion back in 2008. The first opinion comes from the issuer, whereas the second opinion is going to check against what the issuers said.

External reviewers like Cicero provide second opinions at the time of issuance, including a green rating, and also follow up on impact reports to check agains what the framework had originally promised.

With climate science background, Cicero have the professional know-how to formulate their own methodology to achieve active screening to assign green labels with various shades.

THE ESG POINT OF VIEW

From an impact investing point of view, we would prefer positive screening, which means to integrate ESG screening into the full investment process in managing green bonds.

The assessment should not stop at the project category level. We shall also look into the governance assessment, firms’ policies, targets and programs, and investigate how they are going to implement the framework.

On the other hand, the assessment shall be further extend to the whole eco system. There was a green seafood case highlighted in Cicero’s best practice report, where they found out during the assessment investigation that the most production emission came from the supply chain producing fish feed. If the external reviewers can dig deeper into the framework, there are more chances we could push the issuer to choose suppliers that meet certain green criteria.

When we were doing desk top research for this article, we were happy to see that various institutions, including banks, external reviewers, and policy makers are working towards a more active screening, ESG oriented approach in handling green bonds, social and sustainable bonds. And we believe the pandemic will keep intensifying the focus of companies and investors on ESG factors.

Reference List

- RBC: RBC Sustainable Bond Framework

- CNN: The pandemic is driving a boom in investments to fix the climate crisis

- ICMA: The Green Bond Principles

- Cicero Shades of Green Best Practice Report 2019

Follow us on LikedIn to share your thoughts with us.