The idea behind sustainable finance is exciting – integrating environmental, social and governance (ESG) aspects into your investments to achieve long-term benefits for society on top of generating returns.

But instead of discussing how exciting this idea is, many investors are scared away by too many acronyms and an overly-complicated glossary. Let’s shed some light together on some of the most commonly used terms!

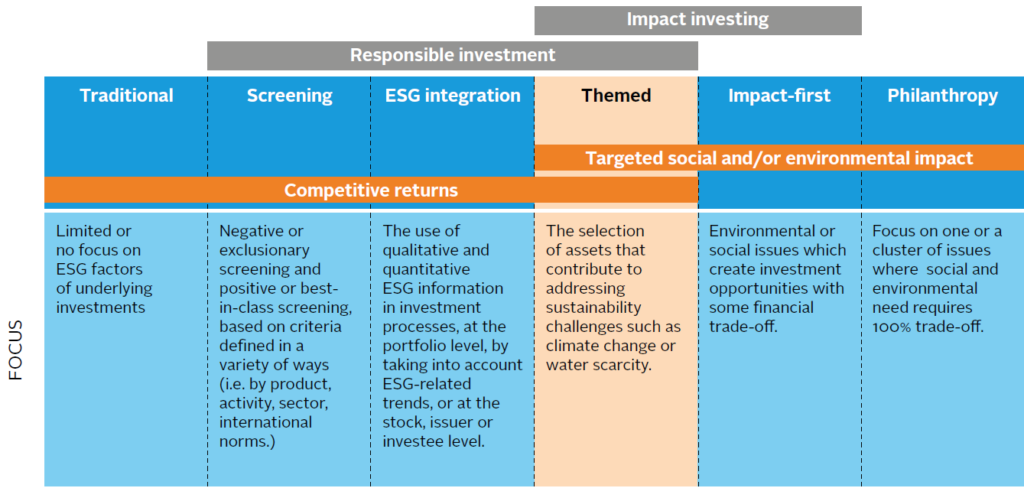

Here is a graphical representation of sustainable finance solutions by the United Nations Principles for Responsible Investing (UN PRI):

As depicted in the table, the main distinction is the following:

- Responsible Investment: main focus on earning competitive returns

- Impact Investing: main concern is to generate Targeted social and/or environmental impact

It is worth noticing how the Themed category represents the “sweet spot”, ticking both Competitive returns and Targeted social and/or environmental impact boxes.

We will not get into the two extremes Traditional and Philanthropy, as the first is not concerned with generating positive impact, while the latter is not looking at generating financial returns.

Let’s look at each category individually:

Screening can be done in two ways, negative and positive. In both cases, the investor sets predefined criteria to either include or exclude securities from selection.

ESG Integration: on top of the traditional financial data, this approach considers Environmental, Social, and Governance aspects when making investment decisions. ESG integration is widely considered a risk-management tool, as it helps to better understand how an industry or a company relates to its environment, society, and its stakeholders.

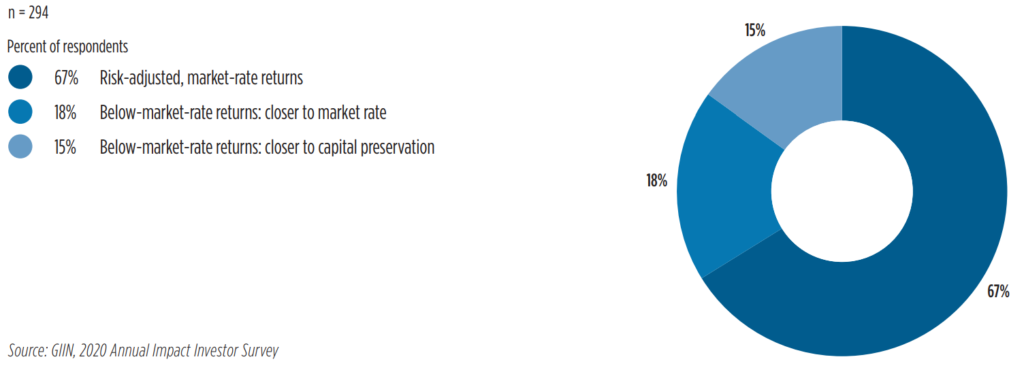

Themed: these are targeted solutions that address a specific issue, such as climate change or financial inclusion. Themed solutions generate high-impact because of their laser focus, but they can still generate competitive returns for investors. According to the “Annual Impact Investor Survey 2020” by the Global Impact Investing Network (GIIN), 67% of impact investors target market-rate returns. The study also shows that, thanks to the thorough due diligence performed by impact investment managers, portfolio performance meets or exceeds expectations in terms of both financial returns and impact achieved.

Impact first: as the name makes clear, the goal of these solutions is primarily the creation of a positive impact for society at large. Because of their priority to create impact, the financial returns stemming from these solutions tend to be below market.

Hopefully you will find this concise glossary helpful and it will bring you a step closer to the wonderful world of sustainable finance.

For any questions you may have, do not hesitate to get in touch!