(Picture: unsplash.com)

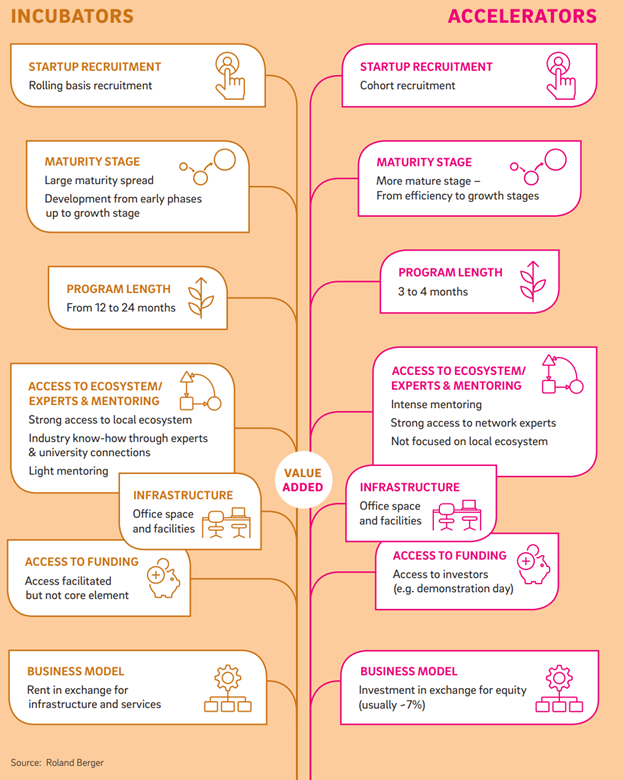

Accelerators and incubators are key players in any entrepreneurial ecosystem. They provide startups with key elements to grow, such as office space, management training, advisory services, connections (through a network of companies and mentors), and access to markets and funding. Accelerators and incubators should not be confused though, as they operate at different stages of maturity of portfolio companies, using different business models and enrollment processes, and providing different services. (Source: Roland Berger – Revisiting the market for innovation)

In this article we aim to shed some light on how incubators and accelerators operate in the impact investing space, and how they contribute to further build the ecosystem.

Their role in the impact investing ecosystem

Impact incubators and accelerators are key players in the social impact ecosystem and act as a bridge between the supply side (capital providers) and the demand side (all types of social purpose organizations, or “SPOs”) within the social impact ecosystem. The supply side (the “capital providers”) is composed of philanthropic organizations and impact investors, while the demand side includes SPOs seeking financial and non-financial support to provide innovative solutions to societal challenges.

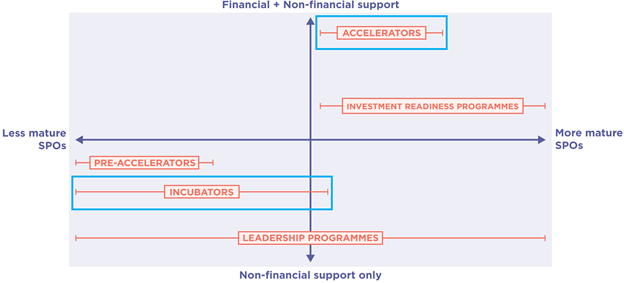

In the impact ecosystem specifically, incubators and accelerators play a pivotal role to support SPOs. Their main responsibility is to help companies throughout their growth process, while also improving their business and impact models. Incubators and accelerators often play a different role depending on the stage of development of the SPO: different stages of development require different types of support, both financial and non-financial.

Chart: “Positioning of incubators and accelerators based on type of support vs maturity matrix (focus on the light blue boxes):

Incubators: they mostly focus on providing SPOs with office space and access to a community of like-minded entities. Incubators rarely provide financial support to SPOs they incubate.

Accelerators: intensive programs (up to three to four months in length) hosting a cohort of between eight to twelve SPOs. These programs apply a strict recruitment process and typically work with companies approaching growth stage. Accelerators can have a specialist approach, focused on a specific thematic area (such as education, health, or the environment for instance) or a generalist approach. Acceleration programs help SPOs to focus on growth and bring their solutions to scale. Accelerators often provide financial support in the form of equity or grants, depending on how the accelerator operates. The non-financial support is typically very practical and includes training modules, mentoring, and coaching opportunities, as well as the possibility to engage with corporations and investors.

It is interesting to highlight that accelerators often take place in incubators. There are two main reasons for this:

- Acceleration programs benefit from communities of SPOs that already exist, and whose offices are based in the incubator

- this allows a more complete offer of services, including office space and shared services

(Source: Roland Berger – Revisiting the market for innovation)

Thematic focus Vs. Generalist

It is worth to dig a little deeper on the difference between thematic and generalist incubators and accelerators.

The application of a specific (i.e. thematic) focus happens from the start of the process, and it is embedded in the way incubators and accelerators vet SPOs based on the societal challenges they are trying to address. As a result, specialist incubators and accelerators often provide tailored and expert-based support around the selected thematic areas. (Source: EVPA Report “Enablers of Impact – The Role of Incubators and Accelerators in Bridging Investment and Solutions”)

In the social impact ecosystem, there are Incubators and accelerators that refer directly to the United Nations Sustainable Development Goals (“UN SDGs”). Several incubators and accelerators have already leveraged the UN SDG framework to focus their action on specific goals. Selecting SPOs that address specific SDGs is an effective way to aggregate data and subsequently communicate the social impact of each cohort of SPOs. The UN SDGs are a well-known framework that gives incubators and accelerators the possibility to keep track of their cohorts’ composition in selected areas (which were chosen by the UN as the main goals to be reached by 2030). This renowned framework is an effective way to encourage programs to become more accountable in terms of impact. (Source: EVPA Report “Enablers of Impact – The Role of Incubators and Accelerators in Bridging Investment and Solutions”)

At AvantFaire we believe in the catalyst role that accelerators and incubators play in building up a social impact ecosystem in Hong Kong and, more broadly, in Asia. For this reason, we have been partnering with Asia-based organizations such as AcceleratingAsia, AngelHub (a sister company of WHub), ImpactHub Shanghai, and the China Social Enterprise and Impact Investment Forum (CSEIF), as they are a fundamental part of building a resilient social impact ecosystem.

As always, we welcome your thoughts in the comments section of our LinkedIn post!