Last week’s post provided some guidance to navigate the sometimes confusing terminology of sustainable finance. Some of the terms referred to impact investing, a niche of sustainable finance that has experienced a steady growth over the past decade. Impact investing happens to be AvantFaire’s expertise and passion, so let’s get into the details!

According to the Global Impact Investing Network (GIIN)’s 2020 Annual Impact Investor Survey, the assets under management (AUM) in the impact investing industry have been growing at a compound annual growth rate of 9% for the period 2015-2019, and the current size of the market sits at an estimated USD 715 billion1.

The GIIN’s survey highlights that 55% of AUM are allocated to developed markets, while 40% to emerging markets. From an Asian impact investor perspective, it is very interesting to point out that over half of respondents plan to increase their allocation to Southeast Asia, and 44% plan to increase the allocation to South Asia. This is expectable given the strong compound annual growth rate in AUM experienced by the two regions between the year 2015 and 2019 (23% for East/Southeast Asia, and 15% for South Asia)2. Over the past few years AvantFaire have been monitoring the market trends in Hong Kong and Asia and we believe that regulators and exchanges (e.g. HKMA and HKEX in Hong Kong, MAS and SGX in SIngapore) have been striving to create the right environment to generate opportunities and attract capital. We believe that Asian investors have indeed allocated more capital to impact investing in the region, which in our opinion fully upholds the findings of the GIIN survey.

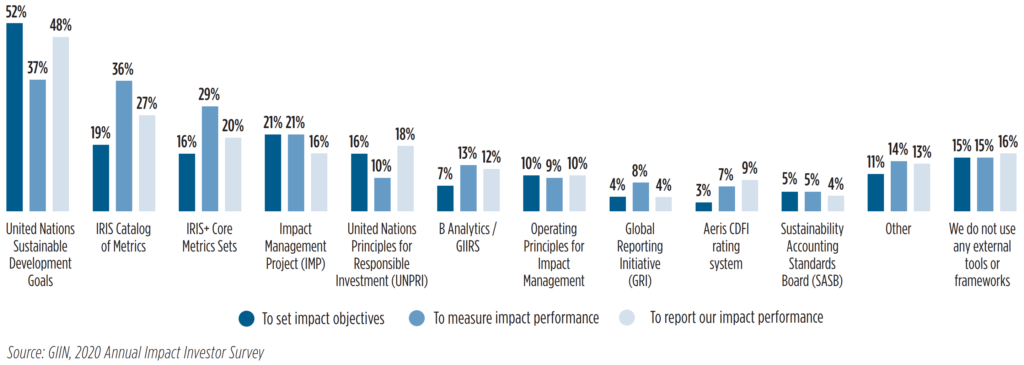

A last aspect worth addressing is the development of impact measurement and management practices, as it represents a crucial aspect of impact investing. Defining, measuring, and reporting on impact is a complex and challenging task, but it is crucial that impact investors get it right. Therefore, it is only natural that a multitude of tools, frameworks, and systems have been developed over the past few years to help address this challenge.

To assess the impact of their investments, investors essentially follow one of three approaches: 1) develop their own proprietary methodology, 2) rely on external systems only, or 3) adopt a combination of the two. In the past decade, the industry has seen a shift from proprietary tools to the adoption of external systems, and it is interesting to see that the average investor uses at least three complementary resources3.

Over the past few years we have been witnessing efforts in the industry to standardize the various measurement and management practices to make impact investing easier to understand and more approachable for investors. As an impact investor, we praise such efforts and initiatives like the UN Principles for Responsible Investing (PRI), the UN Sustainable Development Goals (SDGs) and the GIIN IRIS/IRIS+, which have all been steps towards a common understanding of the industry. However, we are fully aware that a “one size fits all” solution is not possible when it comes to managing impact, because of the incredible breadth of impact investing practices, and the fact that the industry is still developing.

(Source: The GIIN 2020 Annual Impact Investor Survey)

We will go more in depth in an upcoming post on impact management and measurement. In the meantime, please do not hesitate to reach out if you would like to know more about the topic and AvantFaire.

Stay tuned!

1,2,3 Sources: The GIIN 2020 Impact Investor Survey