AvantFaire Investment Management Limited and China Daily Asia Leadership Roundtable co-organized a webinar on “Impact Investing and ESG in Post-COVID Economic Recovery” on June 7th.

Around 150 participants from renowned international organisations, business leaders and investors attended the online panel discussion. The panelist addressed topics from latest trends in impact investment to integration of green initiatives and government policies.

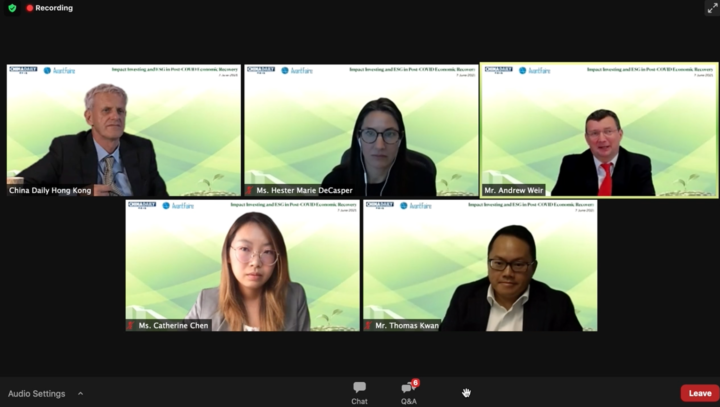

Catherine Chen, the Founder and CEO of AvantFaire, co-moderated the panel discussion with Dr. DJ Clark, the Multimedia Director of China Daily Asia Pacific. The panel invited the guests below to share their insights on the topics.

Ms. Diane Damskey, Head of Secretariat, Operating Principles for Impact Management

Ms. Hester Marie DeCasper, IFC Regional Head of Operations, East Asia and Pacific and Head of Office in the Hong Kong Special Administrative Region

Mr. Thomas Kwan, Chief Investment Officer, Harvest Global Investments Limited

Mr. Andrew Weir, Regional Senior Partner, KPMG Hong Kong and Vice-chairman, KPMG China

Here are the highlights from the panel discussion.

Sustainability Moving to Mainstream

Sustainability has moved from niche to mainstream. The driving force behind such trend is the COP26 (26th UN Climate Change Conference of the Parties) initiative which highlights the commitments to achieve carbon neutrality.

The pandemic also urges companies to re-examine their “purpose” of doing business. Sooner than we know, sustainability will become a must rather than an option. On a global level there has been a significant transition to embedding ESG criteria into investment decisions.

“This purpose ties back to the core of impact investment as investors must target an intentional impact at the outset of an investment contribution,” said Diane in her opening speech.

Integrating Standards with Initiatives

However, people cannot just claim themselves impact investors. Impact investment needs to be verified by an independent party. The market is expecting better regulation on sustainable investment to make sure alignments in impact creation and reporting.

Catherine mentioned that there are many initiatives going trying to align better with the green standards which are evolving everyday. The challenge is to integrate the existing standards with the green industry and its initiatives.

Hester added that, being a signatory to the Principles for Responsible Investment, would help bring investors and institutions closer to the principles and global standard, and also makes impact investors more visible and attractive to the market.

Being a signatory to the Operating Principles for Impact Management (“Impact Principles”), Catherine believed that such seal of recognition is important for both asset managers and asset owners. There are two critical and differentiating elements of being a signatory to the Impact Principles. First, it is an impact operating standard that requires a stringent independent verification. Second, peer signatories are very interactive and supportive.

As Diane mentioned in her keynote, impact investment has its intentionality, contribution and measurability elements. Impact investment is so much needed because it is a patient, sticky, and thoughtful capital. The aim of the Impact Principles is to level up the industry’s consistency, to make possible to compare different assets, and standardize in the assessment and reporting of impact investment management. In short, the Impact Principles grow the market in a disciplined manner.

Energy Transition & Stranded Assets

The investment community is waking up to climate risk, including the risk of stranded assets.

Stranded assets are fossil fuel supply and generation resources that lose their value as a result of the transition to low-carbon economy.

Catherine explained that according to China’s 14th five-year-plan and its commitment to achieving carbon neutrality by 2060 (and Hong Kong SAR to achieve carbon neutrality by 2050), the stranded assets will become one of the critical issues in Asia, especially for the manufacturing and energy industry. Stranded assets become increasingly important when energy transition is taking place. Stranded assets could be the most critical costs for most of the industries.

In Andrew’s opinion, environmental and social risks would finally become financial risks. He pointed out that fact that “Regulators are using the term ‘potential stranded assets’ to show the direction of travel. Business owners and investors have to bring a sustainability lens to everything we do. The key to success is to start examining the current investment framework. A corporate should either shift to a total ESG oriented framework, or at least start the journey asap. Stranded assets could be a very good way of anchoring the future direction of travel”.

Common Green Taxonomy?

The EU Taxonomy is a tool to help investors understand whether an economic activity is environmentally sustainable, and to navigate the transition to a low-carbon economy.

With respect to Mainland China, Catherine introduced the Green Industries Guidance Catalogue (《绿色产业指导目录》) to the panel. China released its new Green Industries Guidance Catalogue in March 2019 to help promote green development through clarifying the definition of “green industry” as well as harmonizing different standards for sustainability.

Catherine further explained that within the Catalogue, there are different green projects funded by the government or under development. There is also a trend that the EU Taxonomy and the China Green Industries Guidance Catalogue are emerging into something similar as compared to what they were before.

Catherine pointed out that it’s not about which standard is better. The question is how we should work together and promote different standards into one.

Thomas mentioned local asset owners need to take the lead because some foreign requirement may not be compatible to the local market. Therefore the investment community and the asset owners need to proactively drive the standard.

Opportunities in China

The roundtable discussion closed with an optimistic note. The panel reached a consensus that in China, government policy is driving the industrial behavior in large scale.

Catherine provided her first-hand insight as a private equity investor in China. She witnessed the private equity industry and the private sector have become more collaborative, especially after the national commitment in carbon neutrality last year, and work together in discussion of operating standardization of projects, engagement with the community and education about impact investing and discerning proper green projects from those with green washing.

Oversea investors are also keen on investing in China green projects. They have become a powerful driver force to collaborate with local entities and industries and integrate themselves into China to catch the green business opportunities.

关于先行投资管理

AvantFaire was established in 2017 in Hong Kong as a licensed impact investment boutique. The company is a new breed of impact investment specialists in Hong Kong, and probably in the greater China region, where impact investing is yet to be a fully defined concept. AvantFaire specializes in a single theme which is impact investing. The mission of the company is to bring impact investment opportunities to investors in Asia and to act as a role model in impact investing. AvantFaire aligns its investment theme with the United Nations’ Sustainable Development Goals and strives to create measurable impact through making private equity investment. Apart from being the 100th signatory to the Operating Principles for Impact Management in June 2020, AvantFaire is also a signatory to the Principles for Responsible Investment which show the company’s pursue in operating standard and commitment in this field. AvantFaire currently has three business lines in impact investment – managing an impact investment fund of funds, advising on impact investing discretionary mandates and providing impact investing external asset management services to professional and accredited investors in Asia.

.

Further Readings

https://cdroundtable.com/web/rt/press/press?id=e6085c475c7544a9bc30740eafaaf258

https://www.chinadailyhk.com/article/222472#Impact-investing-a-world-of-opportunities

.

.