Introduction

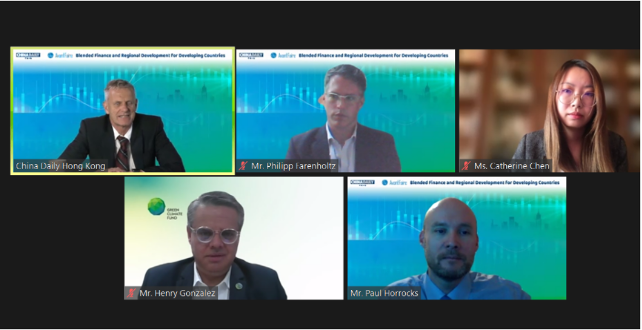

Co-organized by China Daily and AvantFaire Investment Management Limited, the webinar “Blended Finance and Regional Development for Developing Countries” was held on December 7, 2021 from HKT 14:30 to 16:00. The key focus of the webinar is to explore the effects of blended finance for developing countries and regional development as a whole. More than 100 participants attended the webinar. In terms of participants’ profile, their background ranged from business owners, investments to finance professionals. Catherine Chen, Founder and CEO of AvantFaire Investment Management Limited, was invited to participate in the panel discussion together with Philipp Farenholtz from the Blended Finance Department of IFC, Henry Gonzalez from Green Climate Fund and Paul Horrocks from the Organization for Economic Co-operation and Development. Xavier Michon, the Deputy Executive Secretary of the United Capital Development Fund (UNCDF), was also invited to give a keynote address on blended finance. He mentioned how the strategic use of blended finance can unlock capital to sectors that is traditionally not funded by the private sector. Blended finance can also act as a catalyst and unlock funding for these sectors, potentially using donations to offset early losses to protect commercial finance interests. In this way, funds can be provided for projects with commercial impact and development potential. Xavier also addressed the challenges of blended finance, including the measurement of success. He elaborated that enhancing impact and transparency is key to determine what works and what does not. Another key challenge mentioned was the difficulty in scaling. Given that a deal-by-deal approach cannot drive scale, there must be an array of projects available for blended finance to fully take off.

What is blended finance?

Blended finance is the strategic use of development finance for the mobilization of additional funding towards sustainable development in developing countries which can accelerate and expand available capital needed to achieve the SDGs and finance longer-term investments. Capital is provided at a concessional rate to enhance capital mobility by attracting commercial capital towards projects that contribute to sustainable development, while providing financial returns to investors. This innovative approach helps enlarge the total amount of resources available to developing countries, complementing their own investments and ODA (Official Development Assistance) inflows to fill their SDG financing gap, and support the implementation of the Paris Agreement. The benefits of blended finance include job creation, increased social wellbeing and inclusiveness.

Currently, many developing countries lack a common framework required to increase the use of such blended finance. The most recent OECD data shows that out of the amounts mobilised from the private sector by official development finance thus far, approximately only 6% of private wealth has been mobilised in less developed countries, hence there is a lot of room growth in this regard. Some potential aspect on how to improve blended finance includes:

- Attracting more commercial finance;

- Blending across more sectors, countries and SDGs rather than just focusing on middle income countries;

- Coming up with a common framework and understanding of blending to support cohesive action and;

- Having consistent projections of the overall blended finance market to assess effectiveness and identify best practices

In terms of instruments to mobilise private capital, some examples include equity, bonds, mezzanine debt, guarantees & insurance, hedging, grants and technical assistance.

Highlights of Catherine’s Address

Catherine Chen, Founder and CEO of AvantFaire Investment Management Limited, pointed out that blended financing involves an initial investment by public or charitable organizations, as well as follow-up participation by private companies. Compared to traditional impact investing where philanthropic and public entities usually take into account public interests and will focus on themes that support social and environmental development such as those outlined by the United Nations’ Sustainable Development Goals, blended finance essentially creates a win win situation by combining commercial interests with positive social impact through the intrinsic nature of these projects. Private companies can enjoy commercial / financial benefits by investing in social or environmental development projects.

Catherine commented that Avantfaire as a firm is well positioned to capitalize on blended finance as an investment theme as it nicely ties in with the mission to generate both financial return and social/environmental impact on behalf of investors. With the public sector providing catalyst capital at a “concessional” rate, it poses an attractive risk reduction mechanism for private investors as it improves the risk and return profile in these development projects. The enhanced capital mobility brought about by blended finance will encourage more private capital participation in the financing of development projects which have traditionally been side-lined in the past. With a bigger private capital pool, larger scale development projects can be initiated which translates to a bigger positive social impact.

In addition, the partnership between public and private entities can bring about many synergistic benefits. For example, business insights can be shared between partners to improve operational and financial improvements. Private asset owners can also get hands on experience on how to value add to national and international development agenda such as the Paris Agreement as well as SDGs by the United Nations.

Conclusion

In summary, blended finance represents a way to increase private sector participation towards sustainable development. New initiatives, including those supported by mainstream financial institutions, will continue to underline the potential of blended finance as a core business and investment approach in emerging markets. The benefits of blended finance extend beyond capital, since engagement at earlier stages of the investment life cycle translates to a greater potential upside. The reputation enhancement for investors and other stakeholders is beneficial as well. Having greater access to technical skills and market knowledge through local partners will enhance the viability of the investment as well.

About AvantFaire Investment Management

Established since 2017, AvantFaire Investment Management (AFIM) was founded by a group of finance professionals who are passionate about impact investing. We aim to provide access to a curated range of impact investment products that span across traditional and alternative asset classes with the intention of generating both financial return and social/environmental impact. AvantFaire Investment Management Limited (“AFIM”) is licensed by the Securities and Futures Commission in Hong Kong to provide securities advisory and asset management services for professional investors. Currently, AFIM is in the midst of securing a fund management license in Singapore to conduct regulated fund management activities.

Since inception, AFIM has become a signatory to Principles of Responsible Investment (PRI), IFC’s Impact Principals, a member of the Global Impact Investing Network (GIIN), and a certified B Corporation (B Corp). To further strengthen our identity in impact investment, we proactively approach professional organizations and academic institutions for joint research projects, speak regularly in industry conferences and publish articles on impact investment, ESG and sustainability topics.

We look to establish long-term relationships with investment managers to facilitate future partnerships in exclusive co-investment and re-investment opportunities, expanding our deal sourcing and business network, while formulating synergetic strategies with one another such as engaging in joint-research to further create impact and social awareness with the government, regulators, non-profit organizations and portfolio companies.

.

.